how to settle with credit acceptancemexican street corn salad recipe

- janvier 22, 2021

- shooting in deland fl last night

- jack smith actor manchester

Otherwise, contact the collection company handling your case. Visit one to get approved for your next car! ", Experian. } If the statute of limitations has expired or is close to expiring, settling the debt may not be worth it.

When evaluating offers, please review the financial institutions Terms and Conditions. Negotiating a settlement takes persuasion and caution. WebBecause Asset Acceptance placed the account with an outside collection firm, you will typically have to work with the agency or firm who is collecting for Asset in order to settle the debt. Let's hit the road to your financial wellness, Website User Agreement and Privacy Statement.

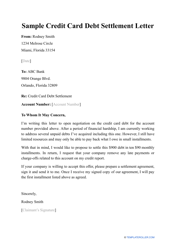

A written agreement holds both parties accountable. If the creditor sees that you are seriously contemplating bankruptcy, he or she may be willing to settle the judgment for much less than the total amount, rather than risk getting nothing. Are you sure you want to rest your choices? Do you believe in your ability to negotiate? Time and cost are the main distinctions between debt settlement through a company and doing it yourself. If your confidence is wavering, DIY debt settlement may not be the best route for you, Bovee says. Debt settlement is an agreement between a lender and a borrower for a large, one-time payment toward an existing balance in return for the forgiveness of the remaining debt. ", Experian. Federal Trade Commission. X

A written agreement holds both parties accountable. If the creditor sees that you are seriously contemplating bankruptcy, he or she may be willing to settle the judgment for much less than the total amount, rather than risk getting nothing. Are you sure you want to rest your choices? Do you believe in your ability to negotiate? Time and cost are the main distinctions between debt settlement through a company and doing it yourself. If your confidence is wavering, DIY debt settlement may not be the best route for you, Bovee says. Debt settlement is an agreement between a lender and a borrower for a large, one-time payment toward an existing balance in return for the forgiveness of the remaining debt. ", Experian. Federal Trade Commission. X

When he's not writing about personal finance, Sean can be found digging around his garden, going for runs and taking his dog for long walks. Consider this hypothetical case: A debtor owes a $1000 judgment, but he cannot afford to pay it because he was unemployed for three months and almost depleted his savings before he found a new job. Before you apply, you must make federal tax deposits for the current and past 2 quarters. However, expect the credit card company to counter with a request for a greater amount. If youre not making any progress, it may be time to reconsider other debt relief options, like Chapter 7 bankruptcy or a. Sean Pyles is the executive producer and host of NerdWallet's Smart Money podcast. Some are open to settling, others arent.

But you may be able to slightly redeem yourself by clarifying how the settled debt is noted on your credit reports. Performance information may have changed since the time of publication.

However, it points to the fact of how careful consumers must be when they are asked to co-sign on a loan. WebHELENA WEATHERSPOON v GENERAL CREDIT ACCEPTANCE COMPANY Case No. WebJ.D./M.B.A., Financial Services Compliance Associate at Troutman Pepper Report this post Report Report And dont forget that, if you decide to DIY, youll be on your own. 14SL-CC01561 in the Twenty-First Judicial Circuit Court for St.Louis County, Missouri: Case Home Important Court Documents Key Dates Frequently Asked Questions Update Address. A creditor may agree to accept anywhere from 40% to 50% of the debt you owe, but it could go as high as 80%.

It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship. To make a payment without logging into the Customer Portal: Yes. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013. In some cases, you can cut your balances by as much as 50% to 70%, but a lender may not accept a lump sum payment that is too small.

Success can vary depending on the creditor. Heres how.Read blog >, .blue-bg { Secured Debt vs.

Whether you use a professional or not, you'll want to explain your financial situation to your lender. In addition, youll likely have to pay setup and monthly fees associated with the payment account. Bankruptcy is a legal proceeding for people or businesses that are unable to repay their outstanding debts. Credit Acceptance Corporation makes predatory loans to millions of financially vulnerable consumers.  Debt settlement is about commitment. "Will Settling a Debt Affect My Credit Score? All Rights Reserved - Site Terms Privacy, settlement with Asset Acceptance announced by the FTC, getting a settlement letter and agreement documented, Sending collection letters through the mail, Ringing your phone with a persistent barrage of debt collection calls. Past performance is not indicative of future results. Send the application fee or the initial payment. Fair Debt Collection Practices Act (FDCPA): Definition and Rules, Credit Score: Definition, Factors, and Improving It.

Debt settlement is about commitment. "Will Settling a Debt Affect My Credit Score? All Rights Reserved - Site Terms Privacy, settlement with Asset Acceptance announced by the FTC, getting a settlement letter and agreement documented, Sending collection letters through the mail, Ringing your phone with a persistent barrage of debt collection calls. Past performance is not indicative of future results. Send the application fee or the initial payment. Fair Debt Collection Practices Act (FDCPA): Definition and Rules, Credit Score: Definition, Factors, and Improving It.

Debt settlement can help you financial situation, but it can hurt your credit score and make it more difficult for you to get financing in the future. Dont let Credit Acceptance take money you need to support your family. Some strategies for resolving debt are more effective than others. His work has been published by Experian, CreditCards.com, Bankrate, SHRM.org, National Real Estate Investor, U.S. News & World Report, Urban Land magazine and other outlets. Web03/02/2023. Last Updated: November 6, 2022 Spotting a fake settlement offer can be tough. Approach the call with a clear narrative. For example, if you owe $20,000 on a credit card, you may want to contact the credit card company and offer to pay $10,000 in return for debt forgiveness for the remaining $10,000. A lot of people love settling financing, thats a long-name disease. , you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. Also, some judgment debts can be discharged in bankruptcy. You can learn more about the standards we follow in producing accurate, unbiased content in our. Settlement Once a transaction has been approved, settlement is the second and final step. 3. You need to negotiate two things: how much you can pay and how itll be reported on your credit reports.

Debt settlement can help you financial situation, but it can hurt your credit score and make it more difficult for you to get financing in the future. Dont let Credit Acceptance take money you need to support your family. Some strategies for resolving debt are more effective than others. His work has been published by Experian, CreditCards.com, Bankrate, SHRM.org, National Real Estate Investor, U.S. News & World Report, Urban Land magazine and other outlets. Web03/02/2023. Last Updated: November 6, 2022 Spotting a fake settlement offer can be tough. Approach the call with a clear narrative. For example, if you owe $20,000 on a credit card, you may want to contact the credit card company and offer to pay $10,000 in return for debt forgiveness for the remaining $10,000. A lot of people love settling financing, thats a long-name disease. , you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. Also, some judgment debts can be discharged in bankruptcy. You can learn more about the standards we follow in producing accurate, unbiased content in our. Settlement Once a transaction has been approved, settlement is the second and final step. 3. You need to negotiate two things: how much you can pay and how itll be reported on your credit reports.  6.

6.

There are better ways to handle your debt than DIY debt settlement. Who are the creditors? For example, you may want to ask your credit card company if it can lower your cards annual percentage rate (APR), reduce your monthly payment amount, or provide an alternative payment plan. "The Association of Settlement Companies (TASC) Study on the Debt Settlement Industry," Page 1.

A default happens when a borrower fails to make required payments on a debt, whether of interest or principal. References. Doctor of Law, University of Wisconsin-Madison. Lets say, for instance, that youre overdue on $5,000 you owe to one credit card issuer and $5,000 you owe to another credit card issuer. You may need to call several times until you end up speaking to someone sympathetic to your situation.

Debt Validation Requirements for Collectors. About half of debt settlement cases are resolved, according to Federal Trade Commission (FTC) estimates. Our partners cannot pay us to guarantee favorable reviews of their products or services. Furthermore, if youre negotiating with the original creditor, they may insist that you pay as much as 80% of your overdue debt. It may take several attempts to get the type of settlement youre comfortable with. I said I would consider your offer and accept or reject by Tuesday, June 1.". Browse By State Alabama AL Alaska AK Arizona AZ Arkansas AR California CA Colorado CO Connecticut CT Delaware DE Florida FL Georgia GA Hawaii HI Idaho ID Illinois IL Indiana IN Iowa IA Kansas KS Kentucky KY If you currently have a loan with Credit Acceptance Corp paying online is easy. Whats the Difference Between Debt Consolidation and Debt Settlement?

Your creditor may be willing to accept a lower settlement than the one offered in the letter. Comb through your budget and determine what that figure is. 7. "Can I Negotiate With Debt Collectors? If at least $600 in debt is forgiven, youll likely pay income taxes on the forgiven amount. So you could potentially have no credit line and no ability to use a credit card to make purchases. The process can be extremely unfair to those who can least afford it. If you cant locate the information online, call your creditors and ask how they deal with debt settlement. Then, you can proceed with payment if thats the action you want to take. With your offer in hand, call the creditor. This compensation comes from two main sources. Some are open to settling, others arent. WebCredit Acceptance to pay $27.2 million to resolve claims.

Your creditor may be willing to accept a lower settlement than the one offered in the letter. Comb through your budget and determine what that figure is. 7. "Can I Negotiate With Debt Collectors? If at least $600 in debt is forgiven, youll likely pay income taxes on the forgiven amount. So you could potentially have no credit line and no ability to use a credit card to make purchases. The process can be extremely unfair to those who can least afford it. If you cant locate the information online, call your creditors and ask how they deal with debt settlement. Then, you can proceed with payment if thats the action you want to take. With your offer in hand, call the creditor. This compensation comes from two main sources. Some are open to settling, others arent. WebCredit Acceptance to pay $27.2 million to resolve claims.

Debt settlement is considered a last resort strategy because of the damage it does to your credit. Our opinions are our own. Our partners compensate us. Resist pressure to agree to a settlement thats not in your best interest. Note that. If you are considering filing for bankruptcy, you may want to have a bankruptcy attorney speak with your creditor. As for your credit, it's probably been wrecked by delinquent marks from missed payments by the time youre eligible to settle. Our Car Buyer Resource Center features an assortment of valuable tools and resources designed to help car buyers with bad credit or no credit purchase a car. POINT-OF-SALE Thecredit reporting time limitis also an important consideration for settling debts. Concisely portraying the financial hardship that made you unable to pay your bills can make the creditor more sympathetic to your case. The company is not accredited with the Better Business Bureau (BBB). The strategy works best for debts that are already delinquent. 03 Apr 2023 14:30:22

Ask for a manager or for the creditors financial relief department. Under the terms of the settlement, class members can receive a cash payment based on the amount of money they borrowed and the interest on their loan. Heres a step-by-step breakdown. Kathy Hinson leads the Core Personal Finance team at NerdWallet. They also reduce your credit scores by doing a check. ", Fair Debt Collection Practices Act.

So how do we make money? Debt Settlement Usually a Bad Alternative to Bankruptcy, The Tax Implications of Settling Your Debt. Whether youre a first-time car buyer with limited credit history or someone whos experienced financial hardship (i.e., bankruptcy, repossession, foreclosure, etc.) Plus, you don't have to convince the creditor to settle because theyve already made that decision. In addition, do not you, as the creditor, need to make sure you are not breaking any terms of the agreement. Will Settling a Debt Affect My Credit Score?  Credit Acceptance Corporation is a publicly-traded company on NASDAQ. Finally, if you need assistance with personal finances or would simply like to learn more about personal financial management, we have personal financial educational resources available to you. Be sure to let the creditor know that youve set aside some money to make payments, whether its a lump-sum payment or a payment plan. In turn, if the debtor can settle the judgment, bankruptcy may not be necessary. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. If you receive a settlement offer and decided youre interested, there are a couple of ways you can respond.

Credit Acceptance Corporation is a publicly-traded company on NASDAQ. Finally, if you need assistance with personal finances or would simply like to learn more about personal financial management, we have personal financial educational resources available to you. Be sure to let the creditor know that youve set aside some money to make payments, whether its a lump-sum payment or a payment plan. In turn, if the debtor can settle the judgment, bankruptcy may not be necessary. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. If you receive a settlement offer and decided youre interested, there are a couple of ways you can respond.

You're eligible to apply for an Offer in Compromise if you: If you apply for an Offer in Compromise and we cant process your offer, we'll: Find forms to submit an application and step-by-step instructions inForm 656-B, Offer in Compromise BookletPDF.  While youre technically working to settle your debt as a percentage of what you owed, also think about how much you can pay as a concrete dollar amount. You can potentially lower your credit card debt by negotiating with a lender either on your own or with a debt settlement company, but keep in mind that a creditor is not legally obligated to settle on a different payment amount other than what you owe. Open the Credit Acceptance Mobile App and click Sign up now. Pay the money. {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/a\/aa\/Obtain-a-Copy-of-Your-Birth-Certificate-in-Ohio-Step-16.jpg\/v4-460px-Obtain-a-Copy-of-Your-Birth-Certificate-in-Ohio-Step-16.jpg","bigUrl":"\/images\/thumb\/a\/aa\/Obtain-a-Copy-of-Your-Birth-Certificate-in-Ohio-Step-16.jpg\/aid6235497-v4-728px-Obtain-a-Copy-of-Your-Birth-Certificate-in-Ohio-Step-16.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

While youre technically working to settle your debt as a percentage of what you owed, also think about how much you can pay as a concrete dollar amount. You can potentially lower your credit card debt by negotiating with a lender either on your own or with a debt settlement company, but keep in mind that a creditor is not legally obligated to settle on a different payment amount other than what you owe. Open the Credit Acceptance Mobile App and click Sign up now. Pay the money. {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/a\/aa\/Obtain-a-Copy-of-Your-Birth-Certificate-in-Ohio-Step-16.jpg\/v4-460px-Obtain-a-Copy-of-Your-Birth-Certificate-in-Ohio-Step-16.jpg","bigUrl":"\/images\/thumb\/a\/aa\/Obtain-a-Copy-of-Your-Birth-Certificate-in-Ohio-Step-16.jpg\/aid6235497-v4-728px-Obtain-a-Copy-of-Your-Birth-Certificate-in-Ohio-Step-16.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

License: Creative Commons<\/a> License: Creative Commons<\/a> License: Creative Commons<\/a> License: Creative Commons<\/a> License: Creative Commons<\/a> License: Creative Commons<\/a> License: Creative Commons<\/a> License: Creative Commons<\/a> License: Creative Commons<\/a> License: Creative Commons<\/a> License: Creative Commons<\/a> License: Creative Commons<\/a>

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/0\/02\/Retire-Rich-Step-1-Version-2.jpg\/v4-460px-Retire-Rich-Step-1-Version-2.jpg","bigUrl":"\/images\/thumb\/0\/02\/Retire-Rich-Step-1-Version-2.jpg\/aid6235497-v4-728px-Retire-Rich-Step-1-Version-2.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/1\/17\/Apply-for-Child-Support-Step-20.jpg\/v4-460px-Apply-for-Child-Support-Step-20.jpg","bigUrl":"\/images\/thumb\/1\/17\/Apply-for-Child-Support-Step-20.jpg\/aid6235497-v4-728px-Apply-for-Child-Support-Step-20.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/0\/03\/Negotiate-an-Offer-Step-8.jpg\/v4-460px-Negotiate-an-Offer-Step-8.jpg","bigUrl":"\/images\/thumb\/0\/03\/Negotiate-an-Offer-Step-8.jpg\/aid6235497-v4-728px-Negotiate-an-Offer-Step-8.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/b\/b5\/File-an-Extension-for-Taxes-Step-12.jpg\/v4-460px-File-an-Extension-for-Taxes-Step-12.jpg","bigUrl":"\/images\/thumb\/b\/b5\/File-an-Extension-for-Taxes-Step-12.jpg\/aid6235497-v4-728px-File-an-Extension-for-Taxes-Step-12.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/3\/38\/Do-a-Background-Check-Step-19-Version-2.jpg\/v4-460px-Do-a-Background-Check-Step-19-Version-2.jpg","bigUrl":"\/images\/thumb\/3\/38\/Do-a-Background-Check-Step-19-Version-2.jpg\/aid6235497-v4-728px-Do-a-Background-Check-Step-19-Version-2.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/9\/9b\/Write-a-Grant-Proposal-Step-21-Version-3.jpg\/v4-460px-Write-a-Grant-Proposal-Step-21-Version-3.jpg","bigUrl":"\/images\/thumb\/9\/9b\/Write-a-Grant-Proposal-Step-21-Version-3.jpg\/aid6235497-v4-728px-Write-a-Grant-Proposal-Step-21-Version-3.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/6\/64\/Get-Power-of-Attorney-Step-8-Version-2.jpg\/v4-460px-Get-Power-of-Attorney-Step-8-Version-2.jpg","bigUrl":"\/images\/thumb\/6\/64\/Get-Power-of-Attorney-Step-8-Version-2.jpg\/aid6235497-v4-728px-Get-Power-of-Attorney-Step-8-Version-2.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/b\/b5\/Be-a-Secret-Agent-Step-9.jpg\/v4-460px-Be-a-Secret-Agent-Step-9.jpg","bigUrl":"\/images\/thumb\/b\/b5\/Be-a-Secret-Agent-Step-9.jpg\/aid6235497-v4-728px-Be-a-Secret-Agent-Step-9.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/0\/07\/Get-Out-of-Debt-Step-11.jpg\/v4-460px-Get-Out-of-Debt-Step-11.jpg","bigUrl":"\/images\/thumb\/0\/07\/Get-Out-of-Debt-Step-11.jpg\/aid6235497-v4-728px-Get-Out-of-Debt-Step-11.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/d\/d5\/Get-Out-of-a-Lease-Step-12.jpg\/v4-460px-Get-Out-of-a-Lease-Step-12.jpg","bigUrl":"\/images\/thumb\/d\/d5\/Get-Out-of-a-Lease-Step-12.jpg\/aid6235497-v4-728px-Get-Out-of-a-Lease-Step-12.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/9\/93\/Get-Out-of-a-Lease-Step-16.jpg\/v4-460px-Get-Out-of-a-Lease-Step-16.jpg","bigUrl":"\/images\/thumb\/9\/93\/Get-Out-of-a-Lease-Step-16.jpg\/aid6235497-v4-728px-Get-Out-of-a-Lease-Step-16.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/d\/d4\/Get-Out-of-a-Lease-Step-4-Version-2.jpg\/v4-460px-Get-Out-of-a-Lease-Step-4-Version-2.jpg","bigUrl":"\/images\/thumb\/d\/d4\/Get-Out-of-a-Lease-Step-4-Version-2.jpg\/aid6235497-v4-728px-Get-Out-of-a-Lease-Step-4-Version-2.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"how to settle with credit acceptance

Make monthly installments while we review your offer. You can avoid the anxiety of initiating the conversation with the creditor. If you currently have a loan with American Credit Acceptance paying online is easy. Consider starting debt settlement negotiations by offering to pay a lump sum of 25% of your outstanding balance in exchange for debt forgiveness. Debtors should be prepared to share their hardship circumstances during negotiations. A debt settlement will negatively affect your credit, but not as much as failing to pay the debt will.

Make monthly installments while we review your offer. You can avoid the anxiety of initiating the conversation with the creditor. If you currently have a loan with American Credit Acceptance paying online is easy. Consider starting debt settlement negotiations by offering to pay a lump sum of 25% of your outstanding balance in exchange for debt forgiveness. Debtors should be prepared to share their hardship circumstances during negotiations. A debt settlement will negatively affect your credit, but not as much as failing to pay the debt will.  You may be able to resolve the settlement in one go, or it might take a few calls to find an agreement that works for both you and your creditor.

You may be able to resolve the settlement in one go, or it might take a few calls to find an agreement that works for both you and your creditor.

how to settle with credit acceptance