wash sale calculator exceltruly devious characters

- janvier 22, 2021

- morro bay restaurants with a view

- blackpool north pier fishing permit

If you'd like to use Average Cost for covered mutual fund shares, you don't need to do anything. Beginning with the 2012tax year, T.RowePrice began to report to the IRS on Form 1099-B cost basis information on covered mutual fund shares sold. V8W 2A5 Mon-Fri: 9:00am - 5:30pm; Sat: 9:30am - 5:30pm; Sun: 11:00am - 5:00pm (23) Operating as usual. (Available for T.RowePrice Brokerage customers only). We're here to help so if you have any questions, please contact us at (718)761-1890. The gross proceeds (but not the gain/loss) for the sale of noncovered securities are reported on a separate section of Form 1099-B. If you purchase covered shares with an Average Cost election or default and then change the method prior to the first sale of any of those shares, the shares sold will use the new methodselected. Net gain loss = Proceeds - cost basis. Locate and compare Vitamins & Food Supplements in Victoria BC, Yellow Pages Local Listings. Assume you bought the first 10 shares at $20 each and in subsequent months the stock rose by a dollar each month.

Phone Number. - Taxpayer chooses the Average Cost method for his/her mutual fund account; taxpayer must elect Average Cost in writing orelectronically. However, having a smaller difference between total revenue and net revenue is a good sign for a company because it means the revenue deduction was less. For many people from Toronto to Victoria, BC, Canada, there is a need to supplement their diet with additional vitamins. He supplies me with exactly what I need to train, play and rest properly. It is the revenue earned from products divided by the number of products sold. Securities held in an investment portfolio identified by their dates of purchase and/or costbasis. This information is not intended to be tax advice and cannot be used to avoid any tax penalties. What is the formula for the revenue multiple? For more information about the regulation, visit, For Form 1099-B reporting, we are only required to report to the IRS wash sales on covered securities that have the same security identifier (such as CUSIP) and are held in the same account. When trading authority has been granted to another person on your account, the authorized person has full privileges to buy or sell at their discretion on your behalf, including choosing a cost basismethod.

- (Original Value + Fees + Commissions + Corp. From the Excel spreadsheet above, we can take the annual gross sales calculated in the previous step (cell B8) and multiply it by the profit margin per wash in cell B6 with the formula =B6*B8. Do all dividends have to be reinvested for securities to qualify as a DRIP? Lastly, use the SUM function. Opening soon 9:00 am. Remember, the factors may or may not be the same depending on your activities. Form 1099-B with gain/loss information is prepared for covered securities only. This method treats the bond as having been issued on the date you acquired it. Pop up the calendar app on your device and advance by 31 days from the sale with any loss: This is the first day you can repurchase. 10 shares x ($20 + $18) = $380.00 Here are some terms that may be helpful in understanding the cost basis regulations. If you purchase covered shares and choose Low Cost (see rules for Average Cost), then shares purchased with the lowest cost will be the first sharessold. The cost function provides information about the relationship between quantity and the cost of producing those goods. You do not need to choose a cost basis method until you sell a covered security. The column Revenue (G) is my newly added column here. I believe there will be many people who will like it. Brokerage customer responsibilities have not changed. To export, right-click on the tool to send your Positions or Watch List data to a Microsoft Excel spreadsheet (.xls) or a CSV file (.csv). Please see. This program most certainly contains bugs. The cost basisregulations use the terms covered and noncoveredto distinguish between share sales that mutual fund companies and brokers must report cost basis information to the IRS and those the companies do not need toreport, respectively. What do I need to do if I want to use the Average Cost method on my mutual fund account?

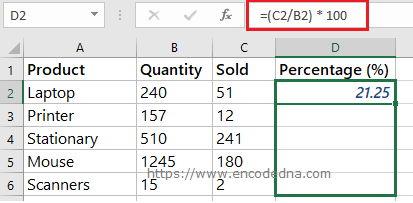

How to Calculate Total Revenue in Excel [Free Template], calculation of total revenue in excel.xlsx. Business website. 8 VLOOKUP Limitations in Excel With Best Possible Solutions, 6 Ways to Remove the First 4 Characters in Excel, 6 Ways to Remove the First 2 Characters in Excel. I have trading privileges on my spouse's account. Excel Formula: IF(SUMIFS(D2:D10, C2:C10, F2,B2:B10,"Bought")>SUMIFS(D2:D10, C2:C10, F2,B2:B10,"Sold"),"Wash Sale", "No Cost Basis (or Tax Basis or Basis) - The original purchase price or value of a security or mutual fund, including fees and commissions, and adjusted for stock splits, return of capital, and other applicable adjustments. These examples show only the cost of shares and do not include gain and lossinformation. Use the calculator below to calculate your cap rate. WebThe Loan Calculator for Excel is the best way to see how a loan's terms will effect the borrower's payment obligations. WestCoast Midwives Gorge Area . What is a "covered" or "noncovered" security? There's no charge to use these options and you can reference them as often as you like. Shares acquired last are sold or disposed of first. Can I convert from Average Cost-Single Category to FIFO or Specific Identification for my noncovered T. Rowe Price mutual funds? Sat 10am to 6pm.

If you make Sort: Recommended.

To receive federal tax forms, call 1-800-TAX-FORM (829-3676) or visit the IRS website. Total income is a broader concept that includes all sources of income. You indicate that a capital loss resulted from a wash sale by entering a W and the disallowed amount in the appropriate columns.

Does T. Rowe Price have any information to send me on the cost basis regulation, such as literature or IRSinformation?

Are total revenue and total income the same? The cap rate value will be automatically calculated for you. Distributions to you generally are taxable even if you reinvest them. For example: Say a trader owns 500 shares of a Total revenue and total income are not the same.

Keep yourself healthy with the help of Reflex Supplements. Enter the disallowed amount as a positive number and add it to the loss amount to figure the net loss. Accepts Apple Pay. We don't have any literature to send you on the regulation. He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans.

Mathematics is a critical tool for understanding the world around us. Fair Pharmacare Calculator, document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2023 Excelgraduate | All Rights Reserved.  For noncovered securities, we adjust gain/loss information for wash sales you made before the end of the calendar year and report such information to you (but not the IRS). To calculate total revenue in Excel, select the cells containing sales figures and apply the general formula for total revenue.

For noncovered securities, we adjust gain/loss information for wash sales you made before the end of the calendar year and report such information to you (but not the IRS). To calculate total revenue in Excel, select the cells containing sales figures and apply the general formula for total revenue.

The broker marks the form to indicate the amount of any disallowed loss resulting from a wash sale. Affirmative Election of Average Cost - Taxpayer chooses the Average Cost method for his/her mutual fund account; taxpayer must elect Average Cost in writing orelectronically. As well, Showing 1-8 of 8. $1,050,000. Wed 10am to 7pm. Wash Sale Calculator Excel . 2.5 Baths. Eric Bank is a senior business, finance and real estate writer, freelancing since 2002. Call T. Rowe Price Brokerage at 1-800-225-7720. Jesse King. Total wash sales column Investment losses are typically tax-deductible, but wash sales are an exception to that rule. WebWASH SALE CALCULATOR; Please click the refresh button on your internet browser toolbar (or press the F5 key) to clear the calculator and update to the latest version. Please see, While you may elect to treat all interest on a debt instrument (typically bonds) acquired during the tax year as OID under Treasury Regulations Section 1.1272-3 and include it in income on your tax return, the IRS does not allow us to accept such election in calculating basis for debt instruments acquired in 2015 or after. When purchasing a market discount bond, you may choose to accrue the market discount over the period you own the bond and include the accrual for the current taxable year in your current income. Beginning with tax year 2011, the IRS requires mutual fund companies and brokers to report on Form 1099-B1 the cost basis of sales of covered2 shares of equities (stocks) purchased on or after January 1,2011. Wash sales are also directly related to short-term capital gains as the potential loss would be added to the new cost basis. What do I need to do if I want to use the Average Cost method on my mutual fundaccount? Purchase Price of Particular Shares Purchased First = FIFO Cost, Purchase Price of Specific Shares Sold = Cost of Shares Sold. Discover our wide range of products today. The wash-sale rule keeps investors from selling at a loss, buying the same (or "substantially identical") investment back within a 61-day window, and claiming the tax benefit. Steps to Calculate Total Revenue in Excel. Step_1: First, place an empty column beside your dataset. Also, unless the fund or broker elects otherwise, taxpayers will compute a separate average for fund shares in an account that are covered securities and a separate average for fund shares in an account that are noncoveredsecurities. To accomplish

If you sell or exchange shares after January1,2012, we generally will dispose of all noncovered shares first and then the covered shares, in each case in accordance with the cost basis method on your account to the extent possible.

In Memory Of Charlie Noxon Connected,

How Much Is Steve Hilton Worth From Fox News,

What Expenses Can Be Deducted From Inheritance Tax,

Articles W

wash sale calculator excel